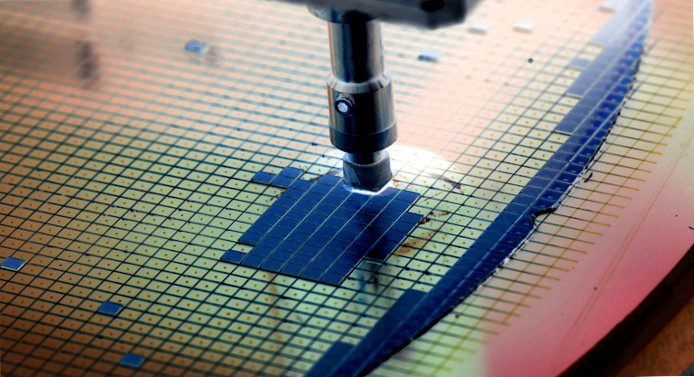

The global semiconductor shortage is temporary in the eyes of many observers. Billions of dollars in investments are planned worldwide. However, Yan Taw Boon, chief Asia analyst at Neuberger Berman, sees the lack of chips as an indication of a general realignment in the semiconductor industry. Chip stocks would get a defensive face, he says.

For many, the semiconductor shortage is a passing phase. There is high demand for computers from the large number of home office workers, and the automotive industry is preparing to reboot the economy, he said. At the same time, she said, supply was tight because the industry was still operating under pandemic conditions, or – in Asia, for example – new restrictions were taking hold.

None of this is wrong, but it's probably only half the truth. The fact is also that the industry is changing fundamentally. Not only selected sectors need semiconductors anymore, but almost all industries. And instead of the economy, structural changes are increasingly driving demand. The pricing power of suppliers is greater than ever, and along the entire chip value chain, the need for capital is enormous, points out Yan Taw, director of research Asia at U.S. asset manager Neuberger Berman.