Central banks around the world are putting the brakes on monetary policy because of rising inflation rates. The result is rising interest rates, which can weigh on the real estate market. Peter Bezak of Zurich Invest explores the question of why investors should now invest in foreign real estate, of all things, at a time when interest rates are expected to rise.

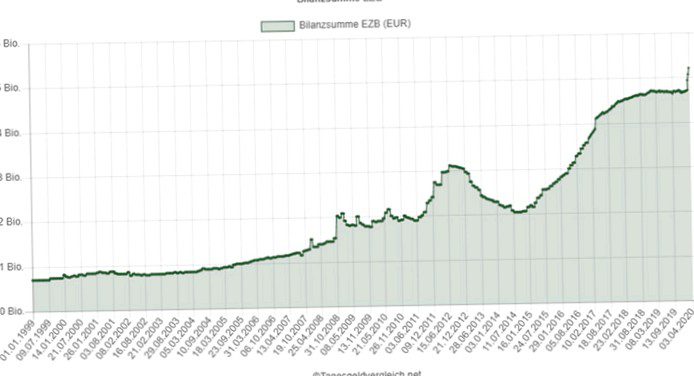

After the temporary slump caused by the Corona crisis, prices on the international real estate markets have recovered strongly in the past year. "Low interest rates have been crucial to the real estate boom of recent years and the associated price increases. Last year, investors benefited from further favorable conditions: In addition to the recovering economy and loose monetary policy conditions, expansionary fiscal policy has also had a positive impact,", says Peter Bezak, economist and investment expert at Zurich Invest.

This year, however, conditions will change. The U.S. Federal Reserve, unlike the eurozone's monetary watchdogs, is backing a tighter monetary policy. Therefore, according to the economist, after the prospect of a first interest rate hike in March, two or three more hikes are to be expected in the course of the year. Rising interest rates could reverse the trend and cause real estate prices to fall again, he further explains. However, as interest rate increases are expected to be moderate, the impact on real estate prices is also likely to remain within tolerable bounds. In addition, price reactions are usually not observed immediately, but only after a certain delay. "Regardless of these factors, real estate is a real alternative to domestic real estate for a variety of reasons", Bezak emphasizes.