Yext hosted a number of panel discussions with managers from leading marketing and digital companies across different areas of financial services to understand the impact of the Corona pandemic on the financial sector. In these discussions, we were able to outline findings from our research on industry trends and tell executives about the impact of the Corona pandemic on their businesses. Also discussed were changes in customer behavior and best practices for dealing with these new realities.

Financial services respondents anticipate the following impact of the Corona pandemic on their businesses:

- 43% of respondents report record levels of business activity and performance

- 14% report a sharp increase in activity, which has since dropped off again

- 29% report some positive, some negative impact on a variety of areas

- 14% report a predominantly negative impact

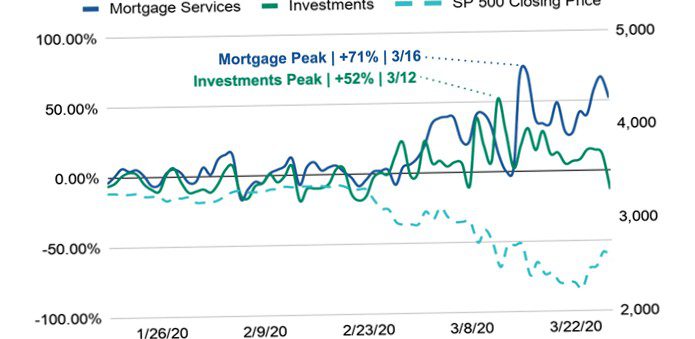

The Corona pandemic has profoundly changed the financial services marketplace. On 22. January, the U.S. officially confirmed the first infection with the novel coronavirus. What followed was a wave of macroeconomic and legislative impacts on all industries in the financial services sector. First, regulations were introduced on domestic isolation, which particularly hurt the travel and hospitality industries. Then the crash in oil prices began. On 23. February was also followed by the crash of the S&P 500. In response, the Federal Reserve System decided to (U.S. Federal Reserve System) on 3. March an interest rate cut to stabilize national liquidity. The result was a boosted mortgage market, leading small and midsize businesses to borrow heavily under the Coronavirus Aid, Relief, and Economic Security Act prompted. They can hardly process this information? This is how many of us feel, the economy was finally completely off the rails for weeks .